The Ayala Group’s contributions to the UN Sustainable Development Goals were given focus at the Nordic Ambassadors’ Luncheon in Shangri-la Fort held last October 26, 2017. TG Limcaoco represented Ayala Group’s Chairman and CEO, Jaime Augusto Zobel de Ayala (JAZA) at the event. With the Nordic countries at the forefront of the campaign in achieving the targets of the SDGs, Ayala presented how it makes a difference in the local arena and how it supports the SDGs as a whole.

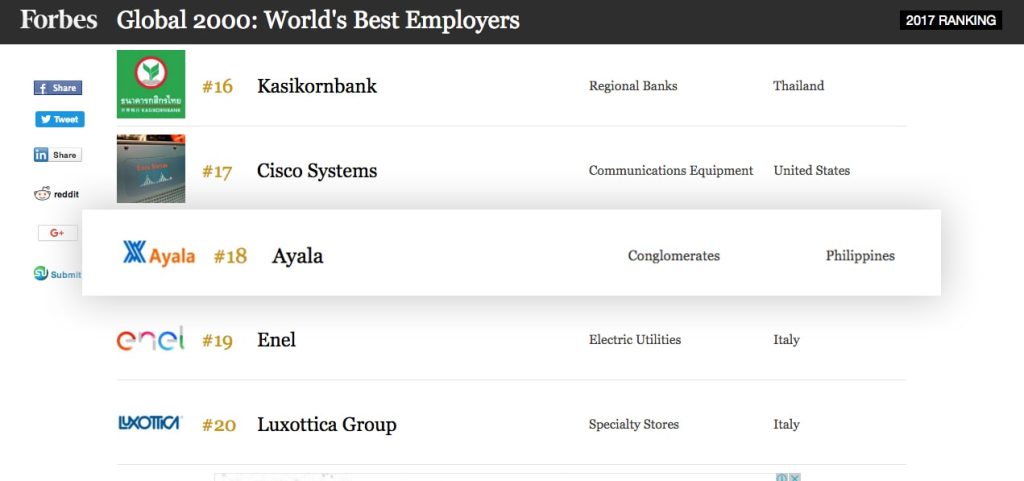

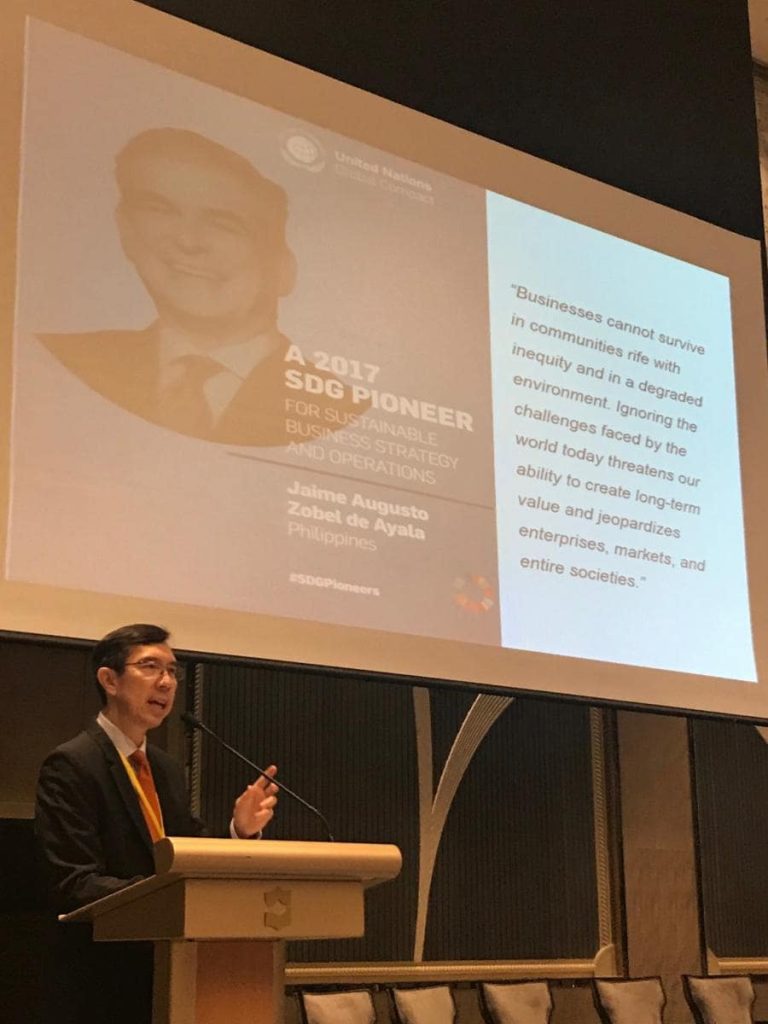

Ayala has aligned its strategies to the SDGs since the inception of the goals – a move that is proven to be significant and commendable given the strategies of other countries to push for the SDGs today. Congratulatory messages were further expressed by the Ambassadors for JAZA for being the first UN Global Compact SDG Pioneer in the Philippines and in Southeast Asia.

The speakers expressed that Nordic countries give prime importance in Sustainability, and in the realization of certain targets: health, education, infrastructure development, climate change, job generation, and peace. These show an alignment with Ayala’s goals and core businesses. At the event, speakers stressed that companies with strong Sustainability efforts have a statistically higher chance for both profit and positive impact in the years to come.

Other notable companies were given light at the event for their Sustainability efforts and strategies such as IKEA, H&M, and Spotify. Some of the Nordic countries also gave a glimpse of their upcoming efforts to further their campaign for a green economy and to further mitigate climate change by 2040. Despite bagging the top four ranks in the index of countries who promote the SDGs, the Nordic countries stressed that they continue to seek more ways to enhance their contribution and efforts. However, there is one point highlighted by Denmark Ambassador Jan Top Christensen: “Without peace, there cannot be development”, and so, the Filipino community was congratulated for the end of the war in Marawi.

The companies present at the event were given the inspiration to continue their businesses with the SDGs in mind. Positive development is seen in the Philippines but more can be done, and the role of the private sector is very significant. As stated by TG Limcaoco, “We cannot discount the relevance of the private sector, and collaborative efforts with other sectors is key.”

With this in mind, Ayala will carry on with its goal of contributing significantly to the SDGs, not because of compliance, but because of the company’s inner drive to make a difference and improve lives.