MANILA, July 5, 2021 — Employees from Ayala’s business units have received their first dose of the COVID-19 vaccine on Monday. The vaccines are part of the first tranche of the 1 million doses secured by the group via tripartite agreements with the government.

On July 5, the group officially launched the Ayala Vaccination and Immunization Program (AVIP) at Makati Stock Exchange and UP-Ayala Land Technohub simultaneously. This will be followed by other ceremonial vaccinations on July 8 at Ayala Malls Manila Bay and BGC Parkade. Ayala aims to inoculate 3,500 individuals this week, including employees and their dependents who belong to the A1 and A2 categories.

“While the reported number of COVID cases has been improving, the fight against COVID-19 continues,” said Chief Human Resources Officer John Philip Orbeta, who was the first to receive the Ayala-ordered vaccine. ” With the arrival of our first tranche of pre-ordered vaccines, we continue to support our national government’s vaccine program, emphasizing the importance of being vaccinated and having that added layer of protection for ourselves and our loved ones.”

As early as March 2021, Ayala employees have been vaccinated against COVID-19. Doctors and healthcare workers of QualiMed Hospital Sta. Rosa were the first medical frontliners outside of Metro Manila to receive vaccines from the IATF and DOH. Through partnerships with LGUs led by AC Health, Ayala employees who belong to the economic frontliner (A4) category have been receiving COVID-19 vaccines since June 14. The group has since established A4 vaccination sites in Quezon City, Taguig, Parañaque, Makati, and Sta. Rosa, Laguna out of a total of 24 sites nationwide. To date, about 6,000 Ayala employees have been vaccinated through local government partnerships.

AC Health President and CEO Paolo Borromeo said, “Through tripartite agreements with the government, Ayala has secured 1 million doses of COVID-19 vaccines for its various communities. Ayala created the AVIP to encourage and facilitate the vaccination of employees (direct and outsourced), retirees, registered employee dependents, household staff, and partners. We are targeting to administer these vaccines by year-end.”

In addition, AVIP also allows registered participants to have one-year access to unlimited medical consultation as well as health monitoring in AC Health’s network of Healthway clinics and Qualimed hospitals nationwide.

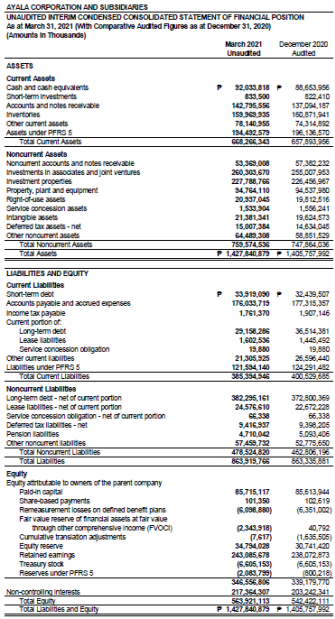

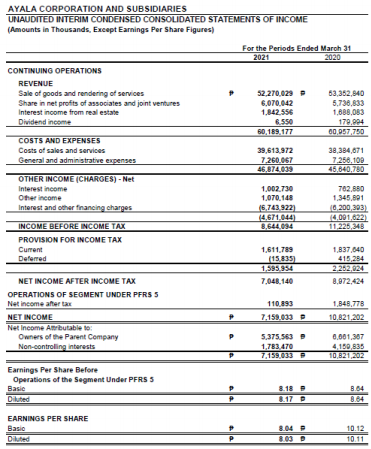

As of May 2021, the Ayala Group has allocated over P16 billion in different COVID-response initiatives. P1 billion was allotted for the pre-ordered vaccines. AVIP is being implemented under #BrigadangAyala.

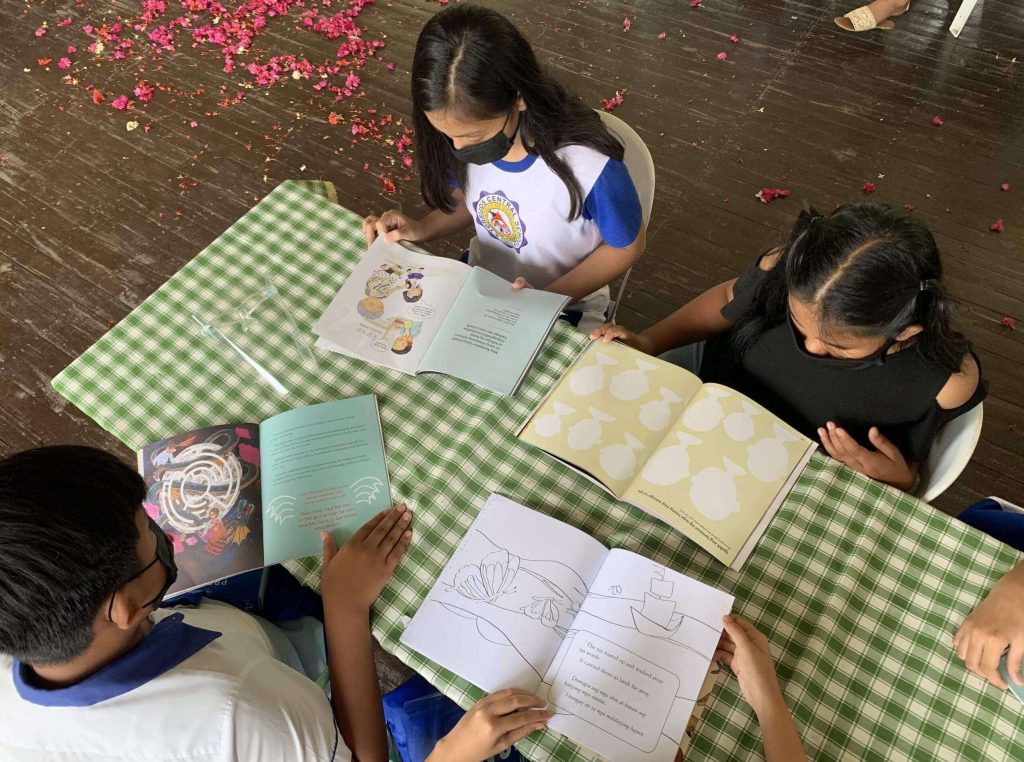

#BrigadangAyala is Ayala Group’s united contribution to serving people and communities nationwide. It is Ayala Group’s integrated response to its almost two century-old commitment to national development by doing various social development and corporate social responsibility initiatives—ranging from disaster relief and response, assistance for public education, championing of social enterprises, and public health advocacy, among others.

######

For more information

Yla Alcantara

Head, Brand and Reputation Management

Ayala Corporation

e-mail – alcantara.ypg@ayala.com