APEC Schools, in partnership with Accenture Philippines, is running the Hour of CodeTM Program for all Grade 7 students across its APEC Schools branches. Together with volunteers from Accenture Philippines, APEC will be organizing computer-coding sessions where every student will be learning the fundamentals of computer programming to help them prepare and succeed in future academic pursuits and employment.

To strengthen the initiative, APEC is collaborating with Accenture to share its technology knowledge and expertise. As a strong advocate of adoption of STEM (Science, Technology, Engineering and Mathematics) education among today’s youth, Accenture has been supporting Hour of Code activities in the country since 2015. Globally, it has conducted Hour of Code activities in close to 200 cities around the globe. APEC will be conducting An Hour of Code sessions that will cover more than 3,000 Grade 7 students from all APEC Schools Branches by the end of this school year.

Under the program, the one-hour introduction to computer science is designed to demystify “code” and provide a fun way of learning computer programming basics. The program aims to foster interest and broaden participation in the field of computer science. It has since become a worldwide effort to celebrate computer science, starting with 1-hour coding activities but expanding to various community efforts.

With the pervasiveness of technology, students’ ability to succeed in any chosen field will increasingly depend on understanding how technology works. At APEC Schools, the use of technology is deeply integrated into the teaching and learning process. Learning with and about technology develops the students’ problem-solving skills, logic, and creativity. It also provides the foundation for success in any 21st-century career path.

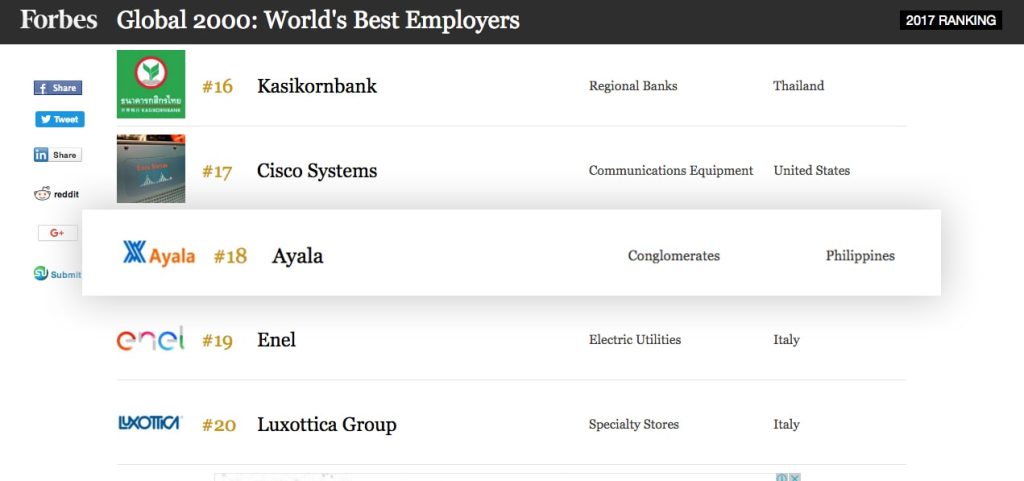

Operated by AC Education, an Ayala company, APEC Schools is the largest private, non-sectarian chain of high schools in the Philippines. It aims to transform millions of lives by providing high-quality yet affordable education and by producing graduates that are ready for college and professional employment.

###

* APEC Schools is operated by AC Education, an Ayala company and presently has 16,200 high school students across 23 branches in the NCR, Cavite, Rizal, and Batangas.

** Accenture is a leading global professional services company, providing a broad range of services and solutions in strategy, consulting, digital, technology and operations. Combining unmatched experience and specialized skills across more than 40 industries and all business functions – underpinned by the world’s largest delivery network – Accenture works at the intersection of business and technology to help clients improve their performance and create sustainable value for their stakeholders. With more than 375,000 people serving clients in more than 120 countries, Accenture drives innovation to improve the way the world works and lives. Visit us at www.accenture.com.

***The ‘Hour of Code™’ is a global initiative by Computer Science Education Week[csedweek.org] and Code.org[code.org] to introduce millions of students in 180+ countries to one hour of computer science and computer programming.