To expand access of reading JAZA’s New Year Message for Ayala group employees, we are publishing the material below.

Dear colleagues and friends,

Welcome to the start of 2018 and I hope you have all had the chance to get some rest in the company of family and friends. A big thank you, upfront, for working to ensure the continued growth and relevance of the Ayala group.

I write this note as part of a new tradition that I wanted to implement this year. So many events happen in any given year and there is never much time to synthesize and bring some coherence and closure to all these thoughts. Today is an attempt, on my part, to try to look back at the year that passed and identify some key themes in the hope of both bringing closure to my thoughts and setting some values based goals for the year ahead. These thoughts will remain broad, macro focused and cover both global and national themes that are relevant to us. Here goes.

As we reflect on the past twelve months, we see trends that persist – both social and economic – that affect many sectors of society. We are increasingly globally interconnected and many of these themes cut across nation states. I believe that it is important for us to take stock of these key trends, and understand how they shape and influence our path forward both as professionals and as stewards of our institutions.

Let me draw attention today to five themes that are the most relevant and that have had a disproportionate impact on our societies in 2017.

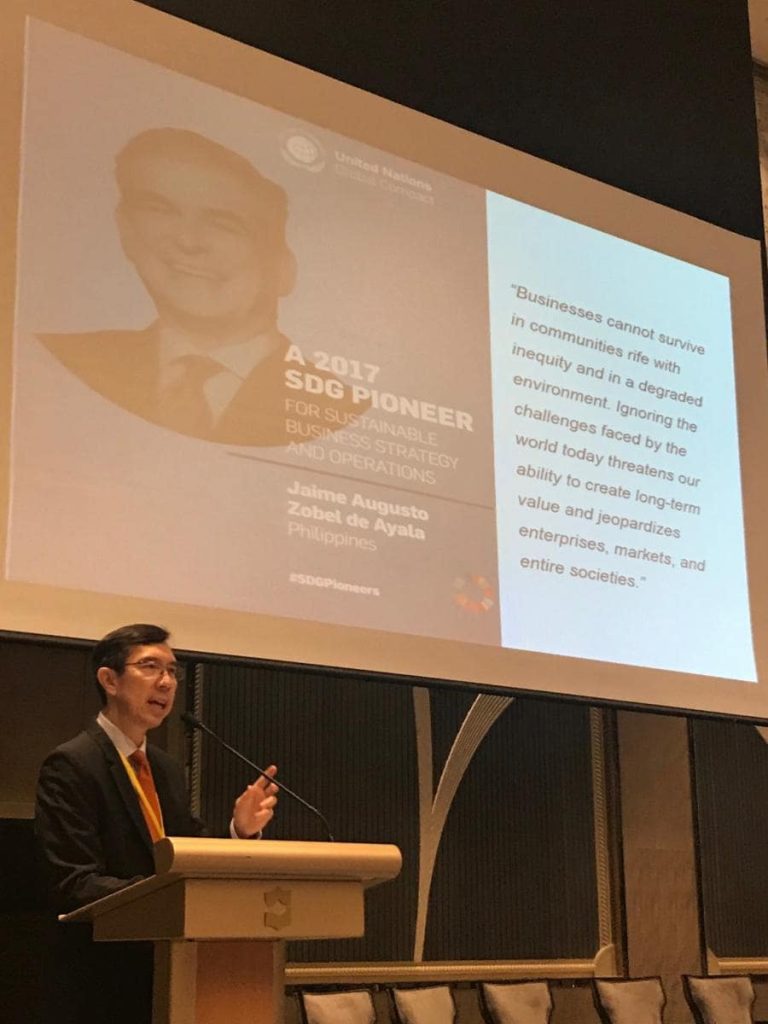

First, let me touch on the rise of populism which has been driven, to a large extent, by both perceived and real increasing social and economic inequity. Second, let me expand on the intertwined themes of globalization and technological advancement, two trends that have been at the center of public debate but whose effects have been, in my opinion, misunderstood. Third, let me emphasize our need to continue to retool and upgrade our workforce in order to successfully navigate the employment challenges brought about by technological advancements and to remain relevant to the changing nature of our industries. Fourth, the need for infrastructure to support our many social and economic requirements remains of unprecedented importance. Finally, let me highlight the indispensable role that the private sector plays in defining and executing on a more comprehensive economic social contract, where businesses build trust and relevance by being contributors to society and not just contributors to a more limited grouping of stakeholders.

VIEW MORE